Ultra-wealthy Americans such as George Soros, Bill Gates and Abigail Disney want to help improve American lives by paying more in taxes.

Credit/Copyright: By Riccardo Savi/Getty Images for Concordia Summit

In February, Buffett told CNBC that “The wealthy are definitely undertaxed relative to the general population.”

California software entrepreneur, Marc Benioff said, “increasing taxes on high-income individuals like myself would help generate the trillions of dollars that we desperately need to improve education and health care and fight climate change.”

Credit/Copyright: By Broadimage/REX/Shutterstock.

Disney and Soros are among the signatories of An Open Letter to the 2020 Presidential Candidates: It’s Time to Tax Us More. This letter starts out saying:

“We are writing to call on all candidates for President, whether they are Republicans or Democrats, to support a moderate wealth tax on the fortunes of the richest 1/10 of the richest 1% of Americans — on us. The next dollar of new tax revenue should come from the most financially fortunate, not from middle-income and lower-income Americans.”

They list six key reasons why they would like to pay more in taxes, which include: investing in the fight against climate change, strengthening the US economy, improving the healthcare system for Americans, closing the large wealth gap, strengthening the democracy, and fulfilling the patriotic duty of all Americans to contribute what they can to the success of the country.

The letter goes on to state:

“Those of us in the richest 1/10 of the richest 1% should be proud to pay a bit more of our fortune forward to America’s future. We’ll be fine — taking on this tax is the least we can do to strengthen the country we love.”

Forbes has compiled a list of additional billionaires who want to meet their patriotic duty by putting their money to work for the American people. Included in this list are Michael Bloomberg, Howard Schultz and Mark Cuban.

Also on the Forbes list, Kaufman & Broad cofounder Eli Broad said, “A wealth tax can start to address the economic inequality eroding the soul of our country’s strength. I can afford to pay more, and I know others can too.”

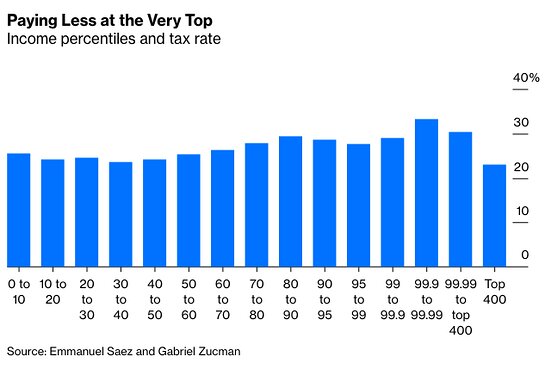

According to an analysis of tax data by the University of California at Berkeley’s Emmanuel Saez and Gabriel Zucman for their upcoming book “The Triumph of Injustice”, in 2018, billionaires paid 23% of their income in federal, state, and local taxes, while the average American paid 28%.

Credit/Copyright: Bloomberg.com

This isn’t the first time the ultra-wealthy have asked for higher taxes. Bill Gates has mentioned it many times, and Warren Buffett wrote about it in 2011.